Париматч Украина: вход и регистрация в онлайн казино

Париматч, букмекерская контора, преуспела на украинском рынке ставок на спорт, став безусловным лидером в этой области. Её история уходит корнями в далекий 1994 год, отмеченный зарождением индустрии беттинга на территории Украины. Сегодняшний день характеризуется миллионами азартных пользователей, отдавших предпочтение Париматч для онлайн-ставок и выигрыша реальных денег. Престиж и доверие к букмекеру были заслужены благодаря ряду преимуществ:

- лицензирование и законность деятельности;

- богатый ассортимент ставок на различные события;

- десятилетия успешной работы на рынке услуг;

- привлекательные коэффициенты;

- сайт с современным дизайном и удобной навигацией;

- опция просмотра видеотрансляций важных событий;

- гарантия честности в расчетах выигрышей;

- персонализированный подход к каждому клиенту;

- высокий стандарт обслуживания;

- широкая сеть наземных пунктов для ставок;

- быстрая и надежная система выплат;

- привлекательная бонусная программа.

Виртуальный клуб открывает широкие возможности для заключения пари каждый день по более чем 1000 различных событий. Ассортимент включает в себя не только востребованные и малоизученные спортивные, а также киберспортивные соревнования, но и мероприятия в мире телевидения, а также политические представления.

Букмекерская контора Parimatch на сайте pari.win тщательно следит за безопасностью своих клиентов, осуществляя непрерывный онлайн-мониторинг для предотвращения любых мошеннических попыток. Особое внимание уделяется сохранности персональных данных пользователей и защите их финансовых активов. В свою очередь, игрокам настоятельно рекомендуется не раскрывать никому данные своего игрового аккаунта, пароль или иные персональные сведения для сохранности своих средств.

✔ Процесс регистрации в Париматч

Париматч, зарекомендовавшая себя букмекерская контора, доверяет информации, предоставленной клиентами при регистрации, и выдвигает всего два основных требования к новым пользователям:

- Запрещено создавать повторный аккаунт, если игрок уже зарегистрирован на платформе.

- Регистрация на сайте становится доступной только после достижения 18 лет.

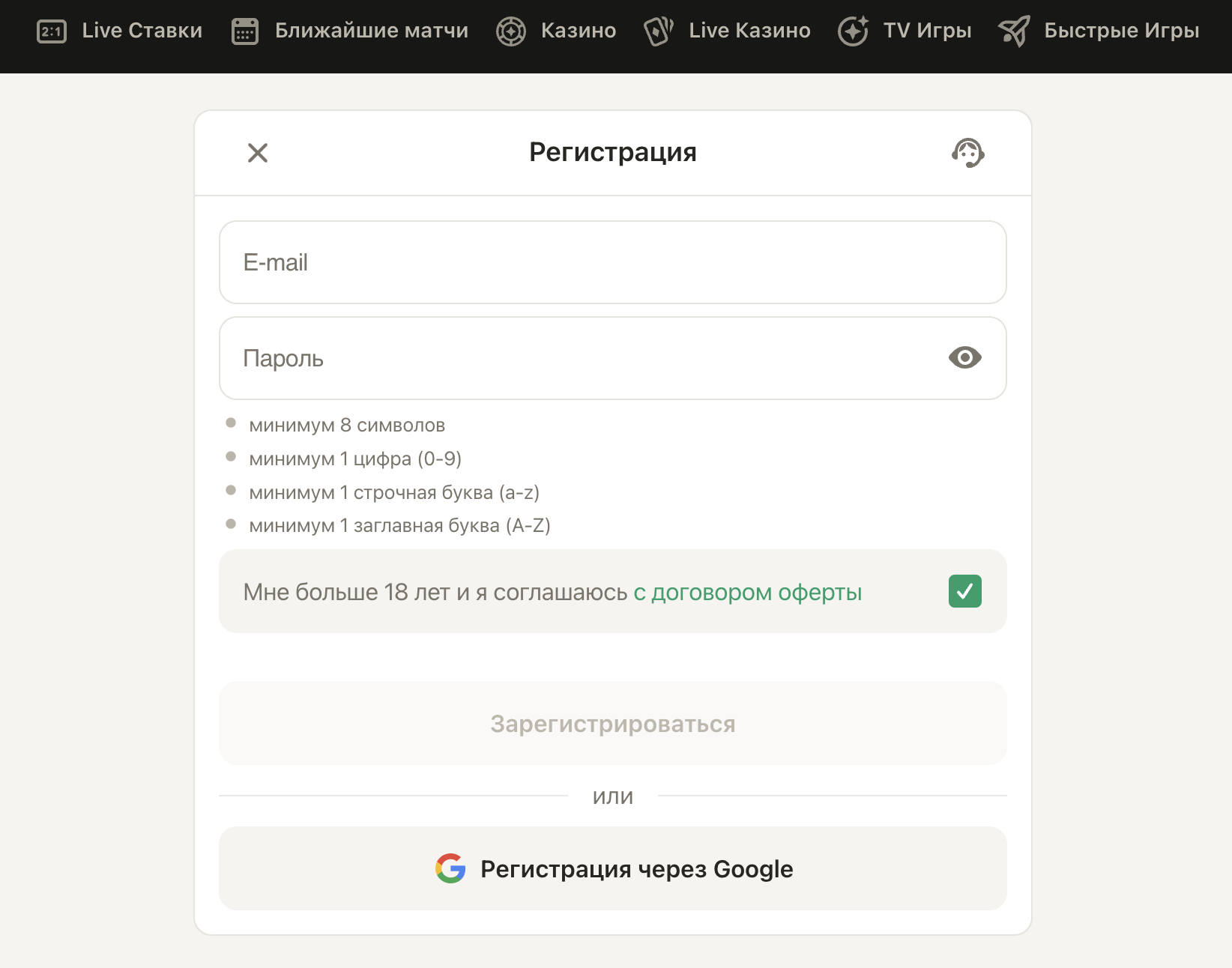

Соблюдая эти условия, клиент может спокойно перейти на официальный сайт букмекерской конторы и кликнуть по кнопке "Регистрация", расположенной в верхнем правом углу экрана. Создание учетной записи возможно как непосредственно на основном сайте, так и через актуальные рабочие зеркала портала.

Чтобы предотвратить возможность использования несовершеннолетними доступа к ресурсам, связанным с азартными играми, администрация сайта рекомендует родителям установить специализированные программы для родительского контроля.

При заполнении формы регистрации необходимо указать свой мобильный номер, выбрать валюту для игрового счета и ставок, а также придумать сложный пароль. Далее подтверждаем свои действия, введя код, который придет в СМС на указанный номер телефона.

Сразу после регистрации пользователь получает доступ к азартным играм и возможность зарабатывать деньги. Кроме того, каждый новый клиент может рассчитывать на приветственный бонус до 2500 грн.

После создания аккаунта каждому клиенту необходимо пройти верификацию личности, так как без этого процесса в Украине невозможно осуществить вывод средств со счета. Для этого нужно зайти в личный кабинет на сайте Париматч, перейти в раздел "Персональные данные" и выбрать "Подтверждение аккаунта". В некоторых случаях, для предотвращения мошенничества, букмекерская контора может запросить дополнительные документы для подтверждения личности. В случае обнаружения недостоверной информации или мошеннических действий, аккаунт пользователя может быть заблокирован.

✔ Вход в личный кабинет Париматч

Неавторизированные пользователи могут лишь ознакомиться с функционалом сайта и играть в демо-режиме в разделе казино. Для совершения финансовых операций, получения бонусов и участия в акциях и турнирах необходимо войти в свой личный кабинет.

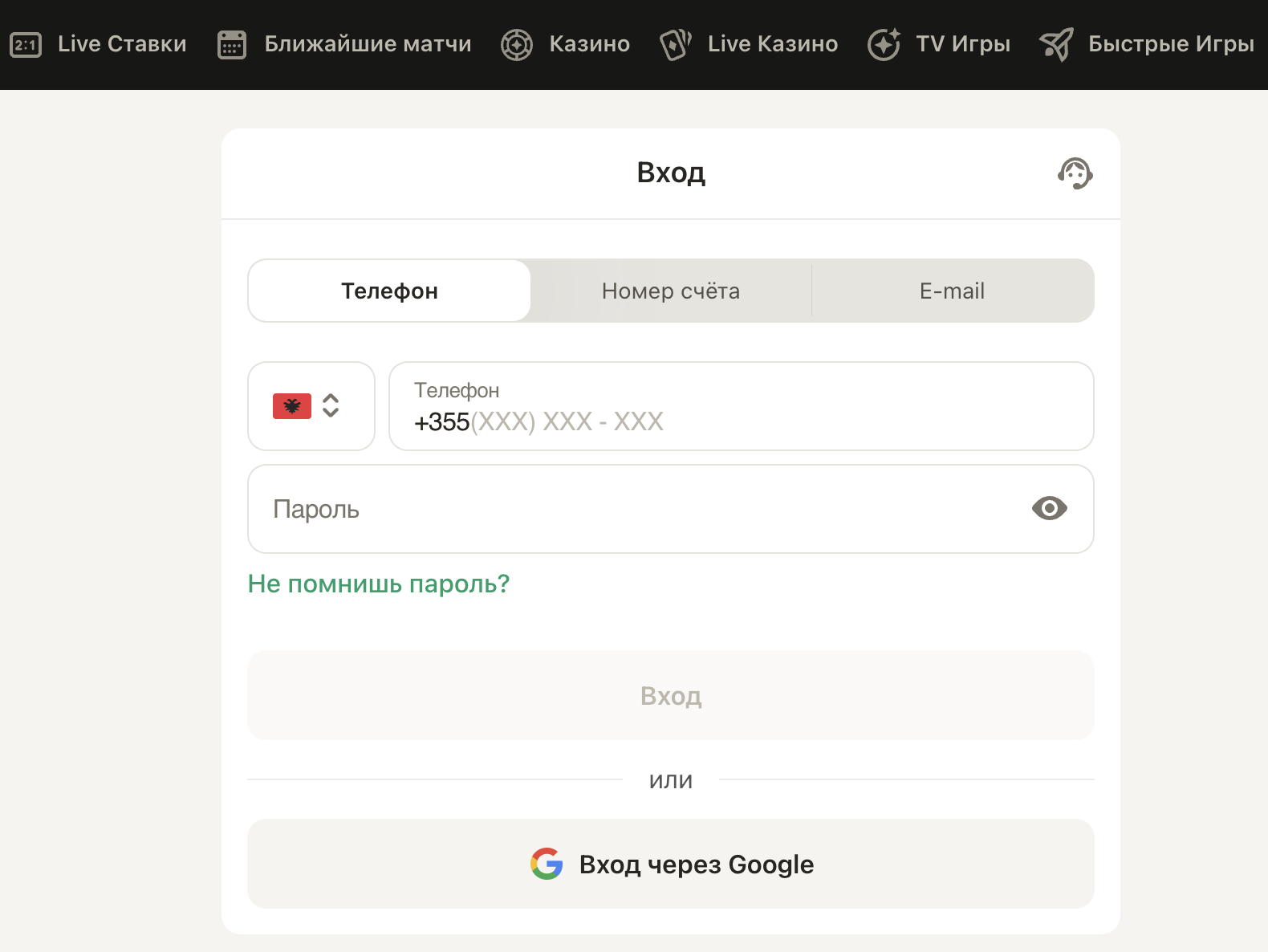

Для доступа к своей учетной записи на сайте Париматч Украина, пользователь может воспользоваться официальным сайтом или актуальным зеркалом, которое предоставляет альтернативный доступ в случае технических проблем или блокировок. На главной странице потребуется найти и нажать кнопку "Вход", после чего ввести свой логин и пароль, которые были заданы при регистрации. Если данные для входа были утеряны или забыты, существует возможность восстановления доступа с использованием функции восстановления пароля или путем обращения в службу поддержки.

✔ Полная версия сайта Париматч Украина

Официальный сайт Париматч Украина был разработан с учетом всех современных требований к удобству и функциональности. Создатели ресурса постарались максимально оптимизировать интерфейс, чтобы даже пользователь, впервые посетивший букмекерскую контору, смог легко ориентироваться по сайту.

Дизайн сайта выполнен в сдержанных тонах, что создает комфортную атмосферу для пользователей. Все разделы и функции сайта структурированы и легко доступны, что значительно упрощает процесс навигации.

Сайт адаптирован для корректной работы на устройствах с различными размерами экрана, благодаря чему пользователи могут без проблем пользоваться ресурсом как с компьютеров, так и с мобильных устройств. Высокий уровень безопасности и конфиденциальности данных на сайте обеспечивается строгим соблюдением политики приватности, что позволяет клиентам не беспокоиться о защите своей личной информации.

Домашняя страница букмекерской конторы Париматч предлагает посетителям мгновенный доступ ко всем основным разделам и функциям, таким как Спорт, Виртуальный спорт, Слоты, Live Казино и другие. Внизу страницы размещены логотипы поддерживаемых платежных систем, информация о правилах компании, ссылки на социальные сети, а также кнопки для скачивания мобильных приложений.

✔ Мобильная версия Париматч

Букмекерская контора Париматч предлагает своим клиентам мобильное приложение, обеспечивающее полный доступ к услугам и функционалу сайта независимо от местоположения пользователя. Мобильная версия сайта оптимизирована для работы на смартфонах и планшетах, обеспечивает низкое потребление интернет-трафика и высокую скорость работы даже при медленном соединении. Интерфейс автоматически адаптируется под размер экрана устройства, что гарантирует удобство использования и четкость изображения на разных устройствах.

Для доступа к мобильной версии сайта Париматч пользователям не требуется скачивать и устанавливать дополнительное программное обеспечение. Достаточно открыть браузер на смартфоне, ввести адрес букмекерской конторы и авторизоваться, используя свой логин и пароль. Мобильная версия сайта предоставляет полный спектр функций, доступных на основном сайте, включая возможность делать ставки, играть в онлайн-казино, получать бонусы, участвовать в турнирах, пополнять счет и выводить деньги. Не требуется повторная регистрация; для входа в личный кабинет используйте существующие учетные данные.

✔ Приложение Париматч

Приложение Париматч является еще одним удобным способом доступа к услугам букмекерской конторы с мобильных устройств. Оно предлагает усовершенствованный пользовательский интерфейс и дополнительные функции, которые могут быть не доступны в мобильной версии сайта. Приложение доступно для скачивания и установки на устройствах с операционными системами Android и iOS. С его помощью пользователи могут быстро и удобно делать ставки, играть в казино, управлять своим счетом и выполнять другие операции, характерные для полной версии сайта.

Чтобы не беспокоиться о возможной блокировке или перегрузке сервера и получать бесперебойный доступ к функционалу сайта, клиенты могут скачать с официального сайта приложение Parimatch на смартфоны, работающие на операционной системе Android, iOS. Только загрузка такого приложения может гарантировать корректную работу ПО, надежную и честную игру.

Данное приложение не занимает много места в памяти устройства и не влияет на работу другого софта. Важно: при скачивании Пари Матч на Android, нужно не забыть разрешить в настройках смартфона установку файлов из сторонних источников. Программное обеспечение букмекера является совершенно безопасным, на него распространяется пользовательское соглашение и политика конфиденциальности.

Игрокам, у которых возникли трудности при создании учетной записи, предлагается обратиться в круглосуточную службу технической поддержки за помощью.

✔ Ставки на официальном сайте Париматч

Париматч – это букмекерская контора с широким выбором ставок на спортивные события. Клиентам доступны как популярные виды спорта, так и редкие дисциплины. Ставки могут делать только зарегистрированные пользователи, пополнившие свой игровой счет.

Для того чтобы сделать ставку, необходимо выбрать интересующее событие, нажать на коэффициент, соответствующий вашему прогнозу, и ставка автоматически добавится в купон. Далее в купоне выберите тип ставки (ординар, экспресс или система), введите сумму ставки (минимум 20 грн), а максимальная сумма ставки будет рассчитана автоматически, исходя из рейтинга игрока, соотношения выигранных и проигранных ставок и других параметров. После этого нажмите "Сделать ставку". Можно делать ставки сразу на несколько событий.

К преимуществам ставок в букмекерской конторе Париматч относятся:

- Обширный выбор видов спорта и подробная роспись событий.

- Возможность запроса VIP-ставки для заключения пари на крупную сумму или с повышенным коэффициентом.

- Наличие видеотрансляций популярных игр.

- Высокие коэффициенты на футбольные и баскетбольные матчи.

- Функция Cashout, позволяющая продать свою ставку букмекеру до начала события.

Таким образом, Париматч предоставляет своим клиентам удобный и многофункциональный инструмент для ставок на спорт, предлагая широкий выбор событий, высокие коэффициенты и дополнительные функции для более комфортного и выгодного беттинга.

Если ставка клиента сыграла, игровой счет автоматически пополняется на сумму выигрыша, а затем эти деньги можно будет вывести на личные реквизиты.

✔ Live ставки Париматч

Благодаря наличию раздела Live на портале Pari Match, у клиентов появилась возможность заключать пари в режиме реального времени. В лайве беттер может быстро переключаться с одного вида спорта на другой через меню в верхней части страницы сайта Пари Матч. В разделе Live отображаются только те матчи, которые должны скоро начаться или уже транслируются.

Parimatch является идеальным букмекером для тех, кто делает ставки не просто, чтобы выиграть, но и получает удовольствие от просмотра спортивных событий, отдыхает во время игры. На сайте БК Париматч онлайн трансляции ведутся по многим матчам. Игроки могут смотреть видеотрансляции только после авторизации учетной записи.

✔ Роспись

Линия событий, выбор видов спорта, глубина росписи исходов в БК Пари Матч значительно выше, чем у других букмекеров, что может порадовать и начинающих, и опытных любителей ставок на спорт. Наиболее широко представлена футбольная линия. Здесь роспись исходов довольно многообразная: от классических исходов, форы, тоталы, включая индивидуальные по клубам и игрокам, до более экзотических вариантов (автор гола, количество аутов или желтых/красных карточек, сколько будет попаданий в штангу и прочее). Таким образом суммарное количество возможных ставок в линии и live превышает несколько сотен. Такой формат спортивных прогнозов особенно ценится тем, что это позволяет ощутить на себе атмосферу игры и получить больше эмоций от победы.

✔ Коэффициенты

На все события букмекер Pari Match предлагает одни из самых высоких коэффициентов на рынке беттинга. На популярные виды спорта и важные спортивные события в БК Париматч коэффициенты более привлекательные, нежели на второстепенные. Такая же ситуация наблюдается между событиями pre-match и играми Live – у вторых коэффициенты заметно ниже. Связано это с большим количеством ставок на матчи основного дивизиона и с низким риском ставок на онлайн-события.

✔ Минимальная и максимальная ставки

Стоит отметить, что букмекерская контора Parimatch очень лояльна к своим пользователям и поставила невысокий минимальный порог для ставки – всего 20 гривен. Такой маленький лимит является одним из лучших среди других букмекерских контор в стране.

Максимальная ставка букмекера Пари Матч в официальных правилах нигде не указывается. Эта сумма напрямую зависит от выбранного типа ставки, рейтинга игрока и других условий. Так, для одних ставок могут быть ограничение в 1000 грн, а для других и вовсе отсутствовать ограничения по максимальной ставке на спорт. Ограничение по сумме ставки клиент может узнать, когда событие будет добавлено в купон.

Сумма ставок на любое событие не может в течение одного игрового дня (по линии, датированной одним числом) превышать указанную в линии максимальную сумму. Ставки на одно и то же событие, по достижению суммарной максимальной ставки по этому событию, не принимаются.

✔ Актуальное зеркало БК Париматч

Иногда у игроков по различным причинам могут возникать проблемы с доступом к официальному сайту Parimatch. Например, из-за технических работ на главном сервере, ограничений со стороны провайдера по требованию законодательства, перегрузки портала. Специально для таких случаев предусмотрены актуальные зеркала Пари Матч – полноценные по функционалу и возможностям копии официального сайта, которые полностью дублируют его работу и имеют аналогичные дизайн, но расположены по другому адресу. Благодаря такой копии, клиенты букмекерской конторы имеют бесперебойный доступ к своему личному кабинету, бонусам, играм и турнирам. Повторной регистрации на зеркале не требуется, если аккаунт был ранее создан.

Самым надежным способом найти актуальную ссылку на копию сайта является обращение к операторам службы саппорта. При этом актуальные адреса публикуются на тематических сайтах, в социальных сетях и мессенджерах букмекерской конторы, а также высылаются на email, если клиент подписан на электронную рассылку

✔ Казино в Parimatch

Париматч предоставляет своим клиентам не только возможность делать ставки на спорт, но и испытать удачу в казино. В разделе "Казино" сайта представлено множество азартных игр, обеспечивающих разнообразный досуг и возможность выиграть крупные суммы.

Игры в казино отсортированы по категориям, что облегчает поиск интересующего развлечения:

- Слоты: огромное количество разнообразных игровых автоматов с различными тематиками и механиками игры.

- Live казино с живыми дилерами: возможность поиграть в классические карточные игры и рулетку с настоящими крупье, транслирующимися в режиме реального времени.

- Быстрые игры: простые и интуитивно понятные игры, в которых можно быстро выиграть или проиграть.

- TV игры: различные лотереи и игры с возможностью следить за ходом в прямом эфире.

- Бинго: различные виды бинго для любителей этой народной игры.

Таким образом, раздел "Казино" на сайте Париматч - это отличная возможность разнообразить свой досуг, попробовать новые виды игр и, возможно, выиграть крупную сумму денег.

В Parimatch внимание уделяется не только разнообразию игр, но и удобству пользователей при выборе слотов. Поиск и фильтрация по тематике игровых автоматов облегчают подбор подходящей игры, а предоставление исключительно лицензионных слотов от ведущих провайдеров гарантирует честность и надежность. Преимущества игровых автоматов в Parimatch включают:

- Высокий процент возврата средств игрокам.

- Большой выбор слотов с различной волатильностью.

- Качественная анимация, детализированные символы и профессиональное звуковое сопровождение.

Игровые автоматы в Parimatch отличаются уникальными темами и разнообразным функционалом, предоставляя игрокам массу возможностей для выигрыша.

✔ Бонусная программа Parimatch

Букмекерская контора Parimatch предлагает своим клиентам щедрую бонусную программу, включающую в себя поощрения как для новичков, так и для постоянных игроков. Получить бонусы могут только зарегистрированные пользователи, пополнившие свой игровой счет. Виды бонусов:

- Бонус за регистрацию: новые игроки получают 100% бонус на сумму первого депозита, но не более 2500 грн. В течение 72 часов после регистрации компания также начисляет 300 фрибетов для ставок на спорт. Важно пополнить счет в течение 7 дней после регистрации для получения бонуса.

- Бонусы для постоянных клиентов: включают в себя кэшбэк в выходные (возврат части потраченных денег) и программу лояльности, предлагающую промокоды для бесплатных ставок, уникальные игровые возможности и другие поощрения.

Таким образом, Parimatch создает привлекательные условия как для новых игроков, так и для тех, кто уже давно является частью сообщества этой букмекерской конторы.

Parimatch активно работает на благо своих клиентов, предлагая разнообразные бонусы и акции, что делает игру на платформе еще более привлекательной. Турниры и акции проводятся регулярно, предоставляя игрокам возможность получить дополнительные выигрыши и бонусы. К тому же, условия отыгрыша бонусов разработаны так, что игроки могут без труда отыграть бонус и вывести средства на свою банковскую карту.

Постоянное обновление промо-акций и специальных предложений на официальном сайте Parimatch делает игровой процесс интересным и динамичным. Рекомендуется подписаться на новостную рассылку от букмекерской конторы, чтобы всегда быть в курсе последних новостей и не пропустить выгодные бонусы и акции.

✔ Легальность и лицензия Parimatch

Parimatch является официальной букмекерской конторой, работающей на территории Украины в соответствии с законодательством. Компания получила лицензию №84 от 09.03.2021 года на ведение букмекерской деятельности, что подтверждает ее надежность и легальность. Это гарантирует, что деятельность компании находится под контролем государства, исключая возможность блокировок и санкций.

✔ Пополнение счета и вывод средств

Для проведения финансовых операций на платформе Parimatch требуется верификация аккаунта. Это обеспечивает дополнительный уровень безопасности как для пользователей, так и для самой компании. Важно помнить, что все операции проводятся в выбранной при регистрации валюте, и изменить ее впоследствии не получится.

Средства на игровой счет можно внести разными способами, включая Apple Pay, Google Play, банковские карты Visa и Mastercard, наличные через терминалы самообслуживания, а также с помощью мобильных платежей. Важно учитывать, что метод пополнения счета и вывода средств должен быть один и тот же. Внесение депозита происходит без комиссии и мгновенно, а средства на личные реквизиты зачисляются в течение 30 минут после подтверждения транзакции.

Таким образом, Parimatch предоставляет своим клиентам удобные и безопасные способы для управления финансами на своем игровом счете.

| ➡️ Название | Париматч Украина |

| ☑️ Варианты названия бк | Пари матч, Parimatch, Pari Match, Паріматч |

| ☑️ Лицензия в Parimatch | Украинская локальная |

| ☑️ Вход в Пари матч Украина | Через email/телефон/номер счета/google |

| ☑️ Год основания | 1994 |

| ☑️ Приложение | Android, iOS |

| ☑️ Язык интерфейса | более 30 языков | ☑️ Live ставки | Да |

| ☑️ Минимальная сумма депозита | 20 грн | ☑️ Живой чат | 24/7 |

| ☑️ E-mail support | Да |

| ☑️ Мобильная версия | Да |

| ☑️ Полная версия | Да |

✔ Отзывы о БК Париматч

БК Париматч пользуется большим доверием среди любителей азартных развлечений, что подтверждается множеством положительных отзывов.

Матвей: "Занимался футболом, был тренером, а теперь полностью переключился на аналитику и ставки. Специализируюсь на футболе и теннисе. Париматч – отличная площадка с широкими возможностями для заработка на ставках. Оцениваю работу БК на отлично."

Федор: "Уже более 10 лет делаю ставки и всегда остаюсь верен Париматч. Линия, роспись, коэффициенты – все на высоком уровне. Особенно радует разнообразие вариантов ставок на футбол. Выплаты всегда вовремя, никаких проблем. Рекомендую всем!"

Юлия: "Ставлю в Париматч уже давно. Коэффициенты отличные, много вариантов для ставок. Выплаты без задержек, всегда в срок. Помимо ставок есть и другие развлечения, например, онлайн-казино. Считаю, что при правильном подходе и расчетах можно всегда оставаться в плюсе."

Таким образом, отзывы пользователей подтверждают высокий уровень надежности и качества услуг, предоставляемых БК Париматч. Клиенты отмечают широкие возможности для ставок, высокие коэффициенты и оперативность выплат, что делает эту букмекерскую контору одной из лучших на рынке.